The installer floor covering dealer other person or business or do it yourselfer must pay sales tax on the supplies used in performing the installation.

Change to nj sales tax for floor covering dealers.

Landscaping landscapers are considered contractors because they work on the land or buildings of others.

Publication anjœ5 about new jersey taxes.

I hired a contractor to remove water and sand from the first floor of my home.

Floor covering dealers rev.

In new jersey certain items may be exempt from the sales tax to all consumers not just tax exempt purchasers.

This means the state considers these.

Do you have economic nexus in new jersey.

Read here for more about amazon fba and sales tax nexus here s a list of all amazon fulfillment centers in the united states.

For more information rev.

When a dealer sells and installs floor covering he pays sales or use tax on the supplies used in the installation.

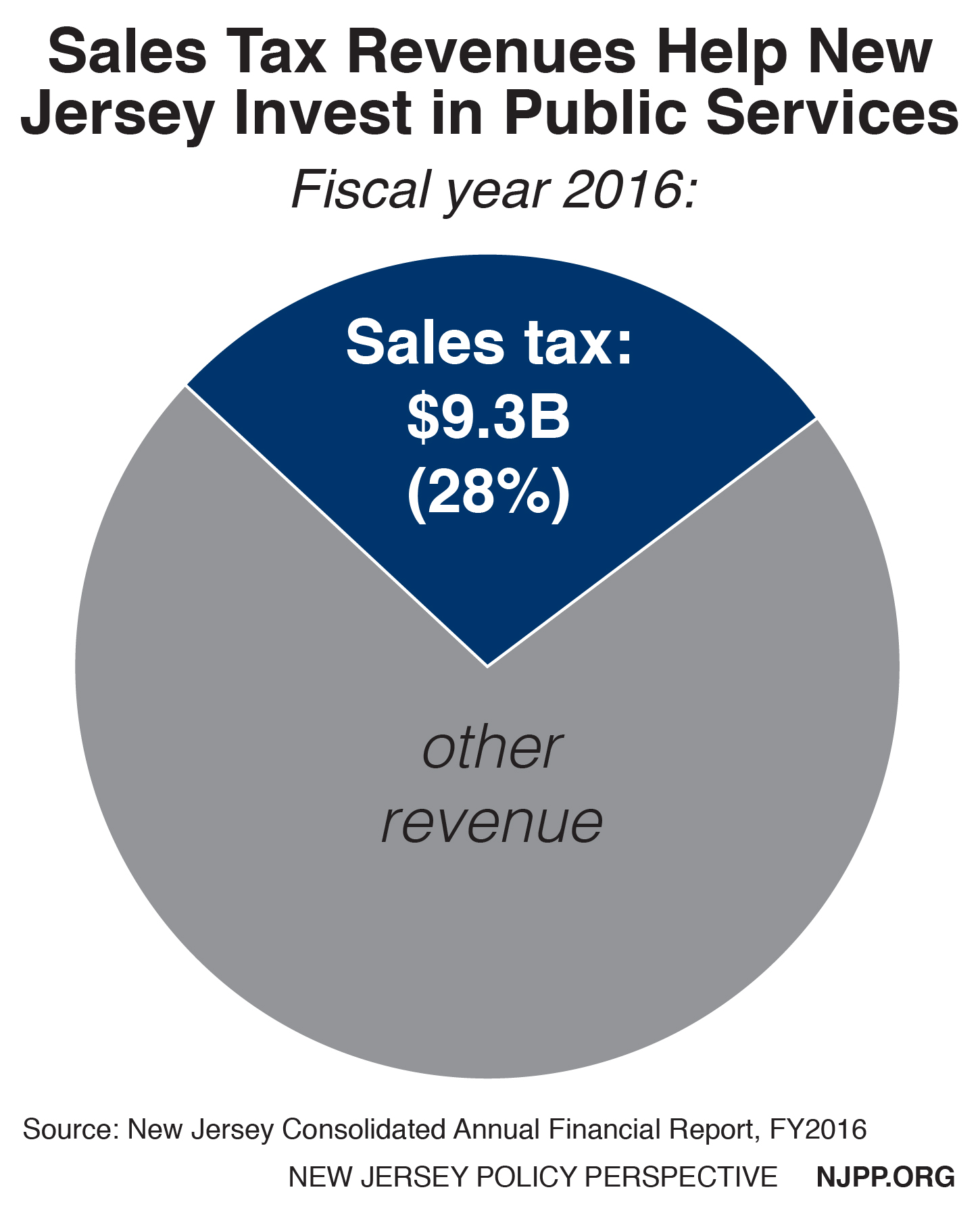

The tax rate was reduced from 7 to 6 875 in 2017.

Effective november 1 2018 new jersey considers vendors who make more than 100 000 in sales annually in the state or more than 200 transactions in the state to have economic nexus.

If the floor covering dealer purchases installation supplies from outside the state and pays sales tax at a rate less than new jersey s 7 rate and the other state has sales tax reciprocity with new jersey use taxmust be paid to new jersey on the cost of the supplies for the difference between the rate in the state where the purchase was made and new jersey s rate.

They follow the same new jersey sales tax rules as other contractors.

Sales tax exemptions in new jersey.

If the floor covering dealer purchases installation supplies from outside the state and pays sales tax at a rate less than new jersey s 7 rate and the other state has sales tax reciprocity with new jersey use tax must.

New jersey division of taxation technical information unit po box 281 trenton nj 08695 0281 many state tax forms and publications are available on our website.

Anj 5 floor covering dealers new jersey sales tax.

Sales and use tax rate effective january 1 2018 the new jersey sales and use tax rate decreases from 6 875 to 6 625.

The removal of water.

This page discusses various sales tax exemptions in new jersey.

While the new jersey sales tax of 6 625 applies to most transactions there are certain items that may be exempt from taxation.

11 00 purchases as a retailer a registered floor covering dealer may purchase floor coverings and installation supplies for resale and not pay sales tax on these items by issuing a new jersey resale certificate form st 3 to the supplier.

However any person who installs floor covering including a floor covering dealer.

For additional information on the installation of floor covering see publication anj 5 floor covering dealers new jersey sales tax.

If the floor covering dealer purchases installation supplies from outside the state and pays sales tax at a rate less than new jersey s 7 rate and the other state has sales tax reciprocity with new jersey use taxmust be paid to new jersey on the cost of the supplies for the difference between the rate in the state where the.

Several examples of exemptions to the sales tax are.

Is this service subject to tax.